DORA implementation steps

The EU’s DORA EU applicable from 17 January 2025, creates a unified regulatory framework for digital operational resilience that requires all types of EU financial entities to ensure they can withstand, respond to and recover from any ICT-related threats.

DORA originates from the increased risks arising from the EU financial services sector’s reliance on ICT, as well as the lack of harmonised EU-level rules on digital operational resilience and the fragmented and inconsistent rules that result at EU Member State level. In line with wider EU efforts to strengthen cybersecurity and address broader operational risks, DORA aims to harmonise and streamline how financial entities’ handle ICT risk management.

Contact our experts Bénédicte d’Allard and Astrid Wagner for further assistance in understanding how DORA could potentially impact your activities.

Produce your DORA register of information in one click

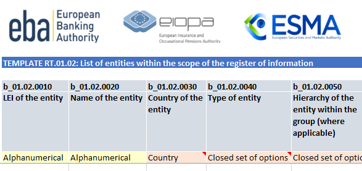

Register of information requirements

- Luxembourg Financial Entities are required to submit their register of information with CSSF by 15 April 2025

- The register of information must be submitted in plain CSV format

- ESA will not provide Financial Entities with a tool/script to generate their register of information

Coverage of the report builder

- Compliant with ESA ITS and RTS at all times

- With auditing functionalities

- Enriched with business data for enhanced use

Delivery model

- Simplified

- Centralised

- Automated

- Error free

- Logic

one click generation

- All CSV files in one folder

- Ready to be filed with the authorities