SFDR 2.0 – EU Commission publishes legislative proposal to review SFDR

On 20 November 2025, the EU Commission (EC) published its final legislative proposal to amend Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (SFDR).

Background

The SFDR was adopted on 27 November 2019 and has been in application since March 2021. Following a comprehensive assessment revealing market misuse of Article 8 and 9 classifications as de facto labels, excessively costly application of provisions considered unnecessary by market participants, and insufficient investor protection, the EC conducted consultations from September to December 2023 and gathered feedback through its call for evidence published on 2 May 2025, ultimately recognising that reform was necessary.

The legislative proposal to review the SFDR represents the current disclosure-based regime’s evolution into a product categorisation system for financial products with minimum safeguards and a reduced scope of application.

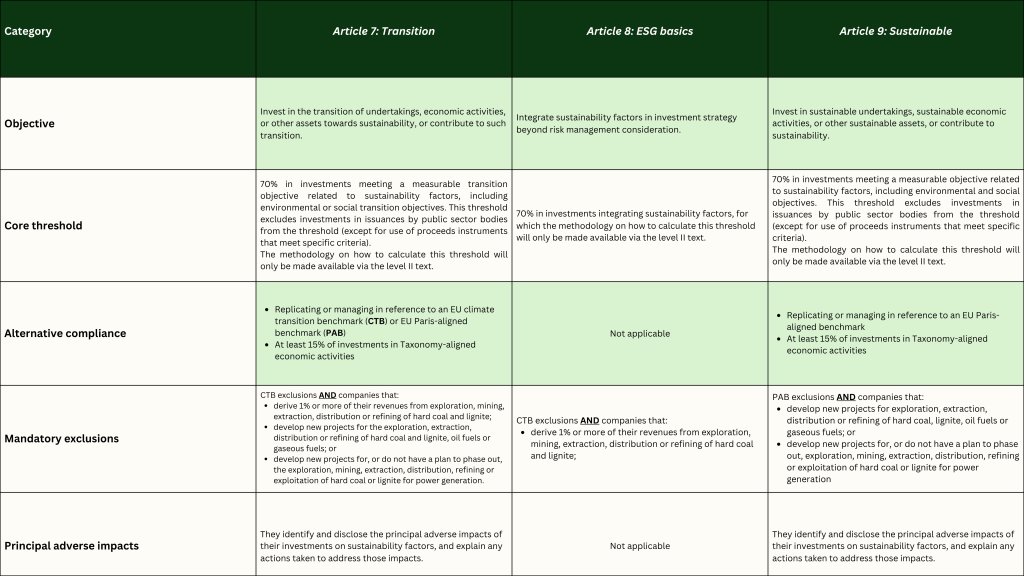

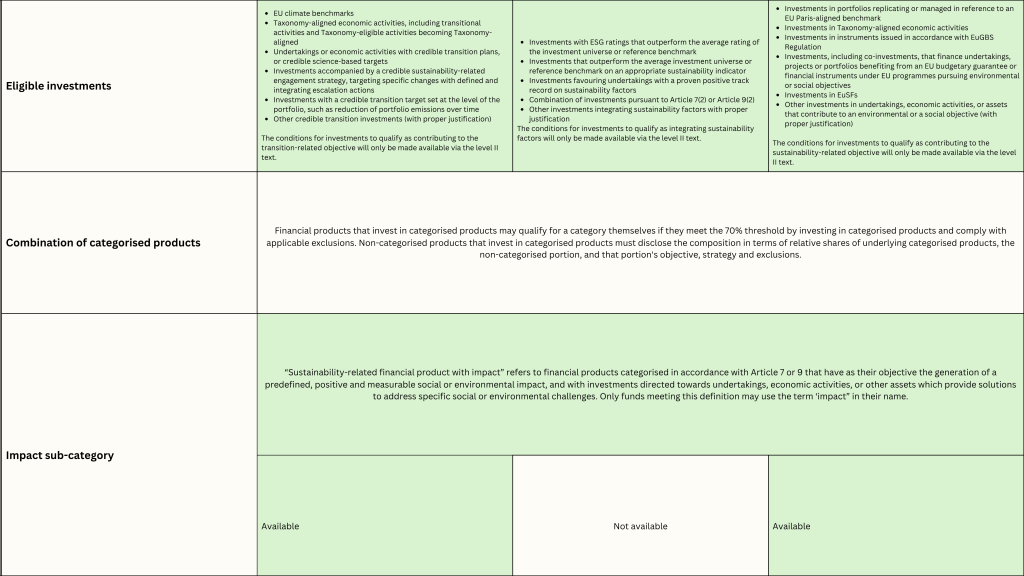

Notably, the proposal abolishes disclosure obligations regarding entity-level principal adverse impacts (PAIs), the integration of sustainability risks in remuneration policies on their websites and the sustainable investments definition while introducing three new product categories under Articles 7, 8, and 9, each with 70% investment thresholds, mandatory exclusions, and predefined investment strategies. This review also introduces targeted disclosure requirements for products falling into these categories and stringent marketing restrictions for non-categorised products, while proposing certain scope exemptions for closed‑ended funds.

Key takeaways

I. Removal of existing requirements

In line with its simplification agenda, the EC proposes eliminating several existing requirements, such as the following:

- Portfolio managers and financial advisers have been removed from the scope of SFDR.

- Financial market participants will no longer be subject to disclosure obligations regarding entity-level PAIs and the integration of sustainability risks in remuneration policies on their websites.

- The definition of “sustainable investments” in Article 2, point (17) SFDR has been deleted, along with the existing “do no significant harm” principle and “good governance” requirements, now captured through the mandatory exclusions.

- Taxonomy-related disclosures will only be required for Article 7 and 9 products (see Section II) pursuing an environmental objective.

- Financial market participants may choose not to apply this Regulation to closed-ended financial products which were created and distributed before the date of application of this Regulation.

II. Categorisation framework

The proposed framework shifts from a disclosure-based system to a categorisation-based regime, introducing three new product categories under Articles 7, 8, and 9, with key requirements for each category:

III. Limited ESG disclosures for non-categorised products

Non-categorised products are permitted to voluntarily make disclosures on sustainability in precontractual documentation provided that the information remains fair, clear and not misleading. However, they face significant restrictions as they cannot:

- use sustainability-related information in fund names or marketing communications;

- make sustainability a central element of precontractual disclosures (must be less than 10% of investment strategy description); or

- include sustainability information in their KIIDs.

In addition, such products must disclose on an annual basis a description of the consideration of the sustainability factors in their periodic reports.

IV. Disclosure requirements

Financial market participants must disclose all relevant information about the relevant category, corresponding sustainability objectives, investment strategies, sustainability-related indicators, applicable exclusions and data sources in precontractual documents, on their websites, and in periodic reports.

The details of the presentation of the information to be disclosed will only be made available via the regulatory technical standards, which will not exceed two pages for Articles 7, 8, and 9 disclosures, and one page for additional impact-related disclosures under Articles 7(4) and 9(4).

Specific disclosure requirements are applicable for PRIIPs that fall into one of the Article 7, 8, or 9 categories.

Next steps

The EC’s publication of the proposal on 20 November 2025 initiates the ordinary legislative procedure, involving negotiations between the EU Parliament and the EU Council. Drawing from the original SFDR level I precedent, adoption could reasonably be expected by May 2027. It would then enter into force 20 days after its publication in the Official Journal of the EU and apply 18 months later. In parallel, the EC will develop delegated acts that will notably specify the disclosure templates through consultations with experts of the Member State Expert Group on Sustainable Finance, the ESAs, and consumer testing. This suggests that full implementation may not occur until the end of 2028

Authors: Adam Zerrouk and Valérian de Jamblinne