Regulatory & Consulting

Forensic Investigations, Corporate Intelligence & Litigation Support

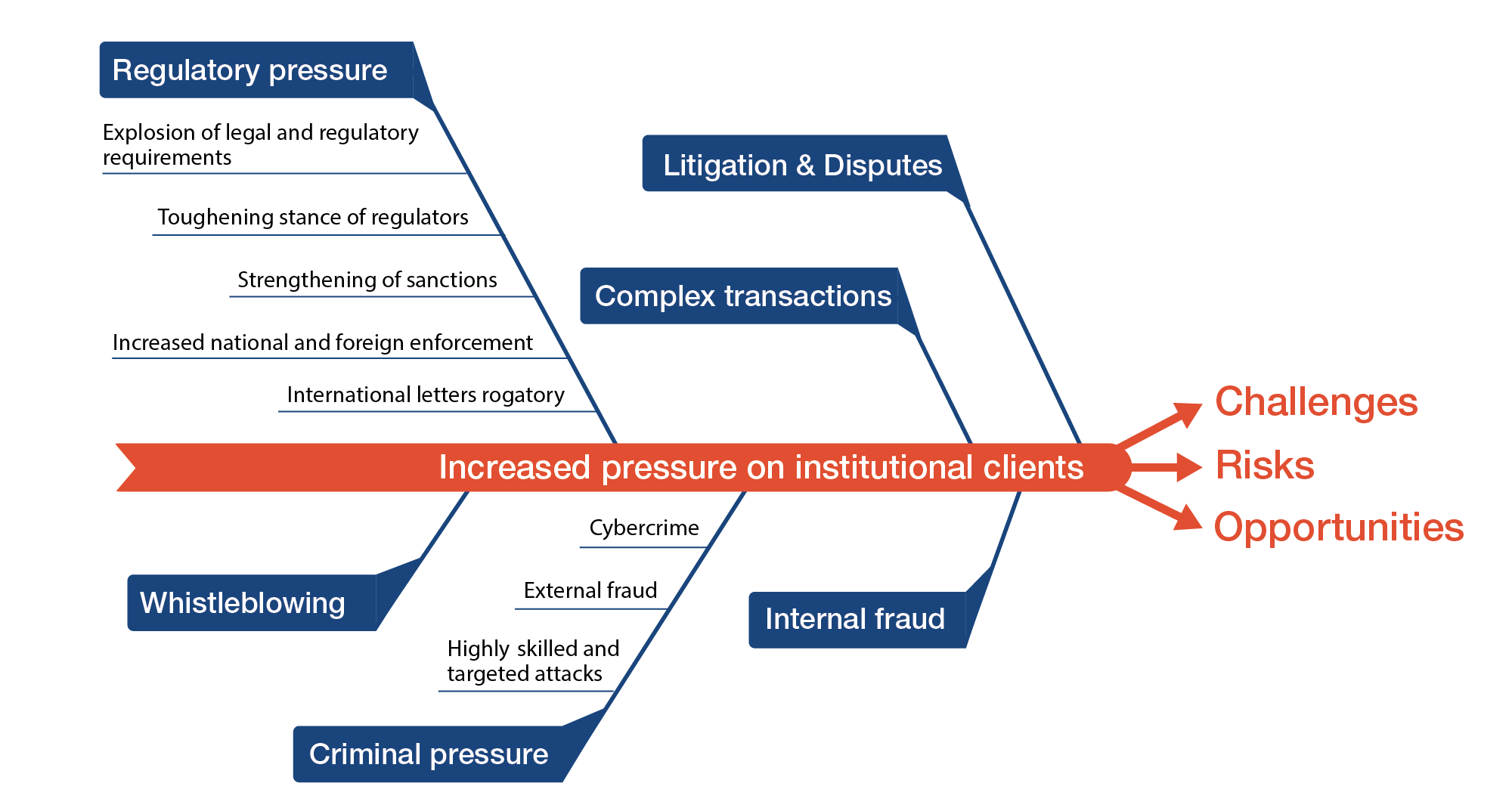

Companies are facing increasing pressure to prevent and detect financial crime and respond to regulators’ investigations

Our experts

A context mixing regulatory pressure and risks

Financial crime such as fraud, corruption, money laundering, embezzlement or data breaches/leaks has a global impact on every facet of a business. This impact goes beyond fiscal and regulatory concerns: direct financial loss, cost of fines and penalties, cost of responses and remediation, brand and reputational damage, loss of market share, low employee morale, diversion of organisational focus and resources, increased scrutiny and regulation, etc.

Focus on forensics

What does it take to uncover white-collar crimes? Investigating white-collar crimes requires specialised expertise, from forensic accounting to digital forensics, corporate intelligence and litigation support. At Arendt, our forensic team brings decades of experience to uncovering fraud, preventing future crimes and supporting legal cases. Each episode highlights the expertise, methods and tools needed to handle complex investigations and support clients in addressing white-collar crime.

We help you to identify wrongdoing and wrongdoers, recover assets, seek legal action and respond to regulators.

An investigation requires immediate action: data need to be collected, preserved and analysed, and key witnesses or suspects identified and interviewed, all while business continues as usual.

Investigations can vary widely: they can change suddenly in scope and are often time critical. They require immediate, decisive action and support from experts.

AML, fraud and corruption prevention and detection

- Detection and mitigation

- Risk assessment

- Transaction and asset flow anomalies

- Provision of key information / evidence to external and internal counsel

Fraud investigations and forensic accounting

- Investigation of suspicions, whistleblowing alerts

- Complex accounting misstatements, Ponzi schemes, kickbacks, embezzlement

- Support during legal action

- Forensic reviews and analysis

Money laundering investigations

- Unravelling of money laundering operations and transactions

- Tracking of illicit funds through shell companies

- Data and social media analysis

- Intelligence gathering

Other regulatory investigations

- Provision of evidence in response to regulators (competition, corruption, ESG)

- Compliance review and remediation

- Collection of facts and evidence to assist legal advisors, assess extent of potential regulatory breach and exposure to regulatory actions, self-reporting

- Identification of irregularities and tracing of fund flows

Supply chain / Procurement investigations

- Intelligence on suppliers’ financial stability, operations, culture, compliance

- Resilience assessment

- Vetting / onboarding / risk assessment / due diligence on suppliers

- Procurement fraud investigations

Workplace misconduct

- Fraud, bribery, information leaks, sexual and other workplace misconduct

- Fact finding

- Independent investigations

- Remediation

Asset tracing and recovery

- Tracing of funds

- Identification of assets in complex schemes and corporate structures

- Assistance with establishing asset positions in contractual disputes, enforcement of arbitration awards, recovery of assets post-litigation or bank collapse

Forensic Technology

Forensic technology plays a crucial role in investigations involving electronic evidence. We assist clients in managing vast amounts of data and navigating the business and legal processes that are set in motion by critical events. Using state-of-the-art software and infrastructure, we offer a range of services that include data collection, evidence assessment and document review, allowing our clients to respond effectively to legal or regulatory incidents and crises.

Digital forensics

- Identification and collection of structured and unstructured data from a wide range of electronic devices (computers, servers, smartphones, cloud-based systems, backup media) in a defensible and forensically sound manner

- Preservation of data integrity and chain-of-custody maintenance throughout the process

- On-site or remote data collection to minimise disruption to the business

- Forensic analysis of collected evidence to detect misuse of internet, email accounts or corporate data

- Recovery of deleted electronic evidence

Electronic discovery

- Early case assessment and triage to focus on relevant datasets only

- Document review administration and end-to-end technical support for review teams

- Cutting-edge technology solutions (keyword searching, structured and conceptual analytics, AI-assisted review) that enable finding the “needle in the haystack” quicker, substantially reducing the cost of investigations

- Redaction and production of relevant evidence for use in court

- Clearly documented audit trail of user actions on the review platform

Strategic intelligence is necessary to inform the investment decisions of corporates, banks, insurance providers and private equity funds.

The line between politics and commerce can be blurred: local business norms can be built on opaque relationships. Bad decisions can destroy an investment and/or increase scrutiny and action from regulators and the authorities.

In any sector and for any transaction, it is critical to:

- Map and analyse the networks and relationships at play in the relevant market and sector

- Assess the extent to which a sector or party may be corrupt

- Advise on the political risks and vulnerabilities associated with an investment

- Analyse the potential effects of changes in government or regulatory regimes

- Carry out targeted enquiries around specific issues or decisions

- Provide contextual or research-backed briefings ahead of meetings and negotiations

- Identify the informal linkages and interests that stand behind key officials and stakeholders

- Investigate the backgrounds of individuals or entities

- Be prepared for post-transaction disputes

Investigative due diligence

- AML and dormant asset due diligence

- Sanctions due diligence

- ESG and corporate sustainability due diligence

- Anti-corruption due diligence

- Third-party due diligence

- Social media risk assessments

- Competitive intelligence

Capital market intelligence

- Shareholder activism

- Short-selling attacks

Corporate contest and hostile M&A

- Target due diligence

- Intelligence on hostile M&A

- Data breaches / leaks

Post-transaction disputes

- Forensic investigation

- Fact and evidence gathering

- Financial and accounting

We help clients to meet AML, anti-bribery and corruption, sanctions and ESG compliance requirements, and to remediate compliance shortcomings.

Risk management

- AML, fraud and corruption prevention and detection

- Ethics programme risk assessment

- Design and implementation of compliance programmes and procedures

- Training at operational level

Investigative due diligence

- Information gathering on stakeholders: counterparty reputations, government officials nexus, undisclosed beneficiaries, etc.

- Pre-transaction due diligence

- Supply chain due diligence, robustness and resilience assessment

- Management culture, governance style and reputation

Corporate compliance advisory

- Compliance function advisory and support services

- Policies and procedures, whistleblowing channels, escalation, response, disclosure

- Assistance with compliance programme design and implementation, tests and assessments

- Training at board and ExCo level

Regulatory investigations

- Assessment and management of regulatory risks

- Response to regulators

- Forensic accounting and investigations

- Remediation

We provide intelligence and evidence gathering expertise for external legal counsels and corporate legal departments. We assist in the reconstruction of event timelines, detailed transaction analysis and relationship mapping, and the identification of conflicts of interest, government nexus and the ultimate beneficiaries of transactions in a forensically sound manner.

Litigation support

- Support to general counsels and external legal advisors

- Reliable intelligence and evidence gathering

- Witness identification

- Financial analysis

- Cross-border investigations

- Fund flow analysis

Asset tracing and recovery

- Tracing of funds

- Identification of assets in complex schemes and corporate structures

- Assistance with establishing asset positions in contractual disputes, enforcement of arbitration awards, recovery of assets post-litigation or bank collapse

- Data and social media analysis and intelligence

Corporate contest and hostile M&A

- Intelligence gathering to prepare defence against hostile M&A

- Protection against and response to shareholder activism

Forensic accounting

- Fraud, complex accounting and financial investigations

- Financial statement accounting misstatements

- Independent internal controls review, fraud risk assessment

- Ponzi schemes, embezzlement, kickbacks

Insights

Financial crime

Companies are facing increasing pressure to detect and prevent financial crime