Arendt is by your side

CACEIS FATCA-CRS

Welcome to Arendt Regulatory & Consulting, your trusted partner in navigating the complexities of FATCA and CRS reporting.

Introducing Arendt’s tax reporting services for CACEIS PERES clients

CACEIS has transitioned its FATCA and CRS reporting services for venture capital, private equity, and real estate funds (the “PERES” clients) to a new partnership with Arendt Regulatory & Consulting. This collaboration ensures that CACEIS PERES clients continue to receive top-tier reporting services through the innovative CACEIS “Connect Store” platform, ensuring seamless compliance and operational excellence.

Arendt offers bespoke reporting solutions using proprietary tools tailored specifically to meet the needs of their clients, notably investment fund managers active in venture capital, private equity, and real estate. Recognized for its regulatory expertise, CACEIS has chosen Arendt to deliver comprehensive FATCA and CRS reporting services to its PERES clients. These services encompass a thorough review of client accounts, entity classifications, IRS registrations, completion of self-certifications and W-series forms, preparation and filing of reports with local tax authorities, among essential tasks to handle this topic efficiently.

Core reporting services

Arendt takes the hassle out of regulatory reporting by managing the entire process for you:

- Identification of reportable accounts and review of FATCA/CRS data

- Generation of XML reports ready for submission, with PDF summaries for internal validation

- Filing with tax authorities, including direct communication with local regulators

Beyond reporting services, a 360° FATCA & CRS Support

Arendt goes beyond the basics to provide full-service compliance support:

- FATCA and CRS classification analysis

- IRS registration and de-registration, including Responsible Officer support

- Completion or review of U.S. W-series forms and CRS self-certifications

- Preparation of investor notifications to meet data protection requirements

- Drafting of tailored FATCA & CRS policies and procedures

- Managed services and quality assurance for your client onboarding processes

What you need to provide

As a PERES client, you just need to:

- Define the scope of the funds and specify the type of report to be prepared (FATCA and/or CRS report)

- Gather information from your Central Administration and provide Arendt with:

- the register of investors

- the applicable end-of-year Net Asset Value (NAV), and

- details of any eligible payments made to investors during the reporting year

On Arendt side, we will review and validate the reports prepared by us, while providing the following services:

- Collect the required data

- Run technical and business controls

- Provide feedback on the completeness and quality of the provided data

- Identify reportable accounts

- Produce XML reports prior to filing, together with a PDF report allowing your officer in charge of FATCA and CRS to validate the content of the XML files

- File the XML reports and liaise with the local tax authorities when relevant

Identification data

– Name ;

– Residence address ;

– Jurisdiction(s) of tax residence and corresponding tax identification number ;

– Date of birth (CRS);

– Place of birth (CRS);

Financial data

– Account number or equivalent ;

– Account balance/value;

– Gross amounts of interest and dividends paid or credited ;

– Gross proceeds from the sale or redemption of financial assets.

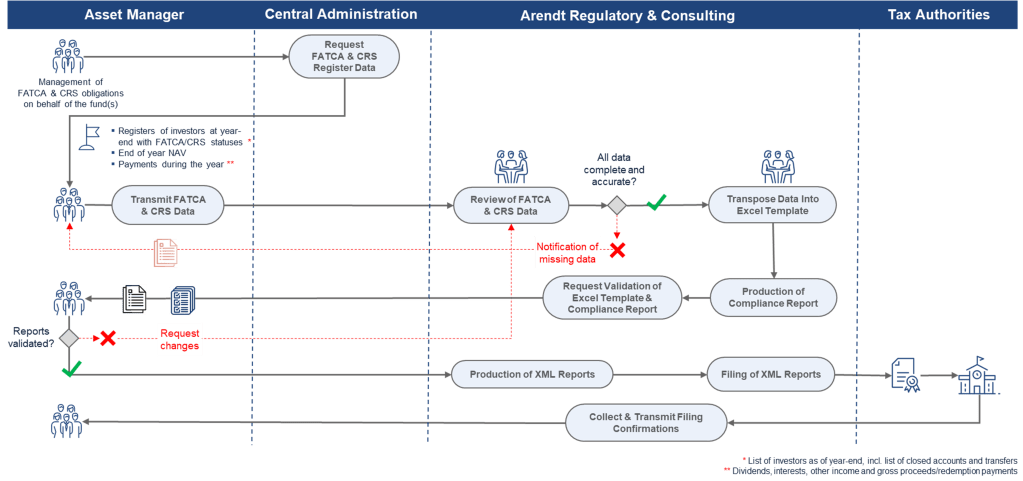

Arendt has worked with CACEIS expert to define a state-of-the-art operating model.

Operationally, this translates into the below workflow.

In any case, Arendt will always adapt to your needs by providing tailor-made solutions aligned to your preferred operating model.

Contact us

For more information on how we can assist you with your FATCA and CRS reporting needs, please reach out to our experts:

yann.fihey@arendt.com

+352 26 09 10 77 60

nicola.losito@arendt.com

+352 26 09 10 77 52

Let Arendt be your guide in the world of regulatory compliance. With Arendt by your side, FATCA and CRS reporting is no stress.